Take the Guess Work Out of Payroll Taxes

with Our Powerful Tax Jurisdiction Look-Up Capability!

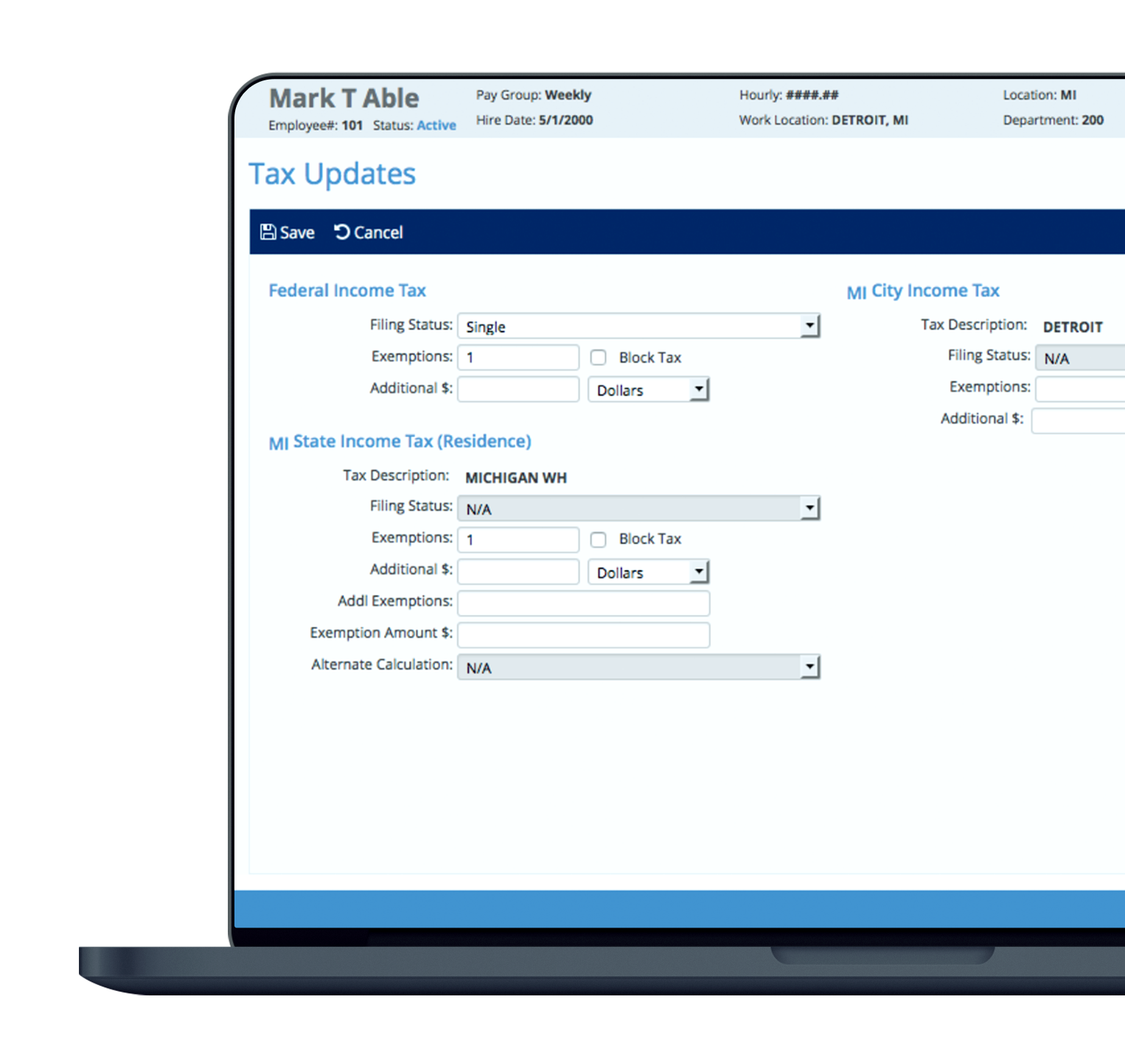

Employers must determine the appropriate payroll taxes for employees based on their resident and work location. In states with local taxes determining the appropriate payroll taxation can be a daunting task. Our isolved payroll solution provides a complete Zip Code lookup to determine the appropriate taxes for the employee’s and client’s jurisdictions.

Additional Benefits of CTR Payroll & Tax Filing Services

- Timely filing and Payment of Payroll Taxes to the appropriate taxing jurisdictions

- Our tax engine is an industry leader in complying with new tax regulations and rate changes

- The Payroll Preview allows the employer to verify the accuracy of the payroll and tax calculations that will be applied to each employee

- Numerous Month-to-Date, Quarter-To-Date, and Year-to-Date payroll and tax reports available at your fingertips

Pennsylvania and Ohio Payroll Processing Services

CTR is proud to be headquartered in Western Pennsylvania near the border of Pennsylvania and Ohio—two of the most challenging states to process payroll due to the ever-changing and complex local payroll tax filing requirements.

Due to the complexities of Ohio and Pennsylvania payroll tax filing, it is crucial to contract with a payroll processing company, like CTR, that truly understands the complexities of Ohio and Pennsylvania.

CTR Payroll is led by a team of experts with over twenty years of experience processing payroll in Pennsylvania and Ohio. Do you currently have employees residing in a variety of local tax jurisdictions? Are you confused about how to calculate Pennsylvania and Ohio taxes and where to properly remit tax payments?

Under PA Act 32 Employers with work locations in Pennsylvania must withhold and remit the local Earned Income Tax and Local Service Tax for employees who work in PA. Employers may simply enter their Zip Code and the system will provide the recommended PSD code and School District for local tax filing in Pennsylvania and Ohio. No more looking up PSD codes—let the payroll software due the work for you right within our application.

This sophisticated geo-code lookup table is powered by Vertex, one of the country’s leading payroll tax engines. Employers may simply enter the employee’s residential address and enter the employee’s work location and the system will populate the correct PSD code for local tax filing in Pennsylvania. No more looking up PSD codes—let the payroll software due the work for you right within our application!

Contact CTR for isolved Implementation and Support

Looking to learn a little more about isolved and how it can totally revolutionize your approach to HR? Contact us and we’ll get you in touch with one of our CTR specialists to help you discover how isolved can answer all your questions.